The Costs of Leaving a House Vacant in Texas

Reviewed by Mark Lee

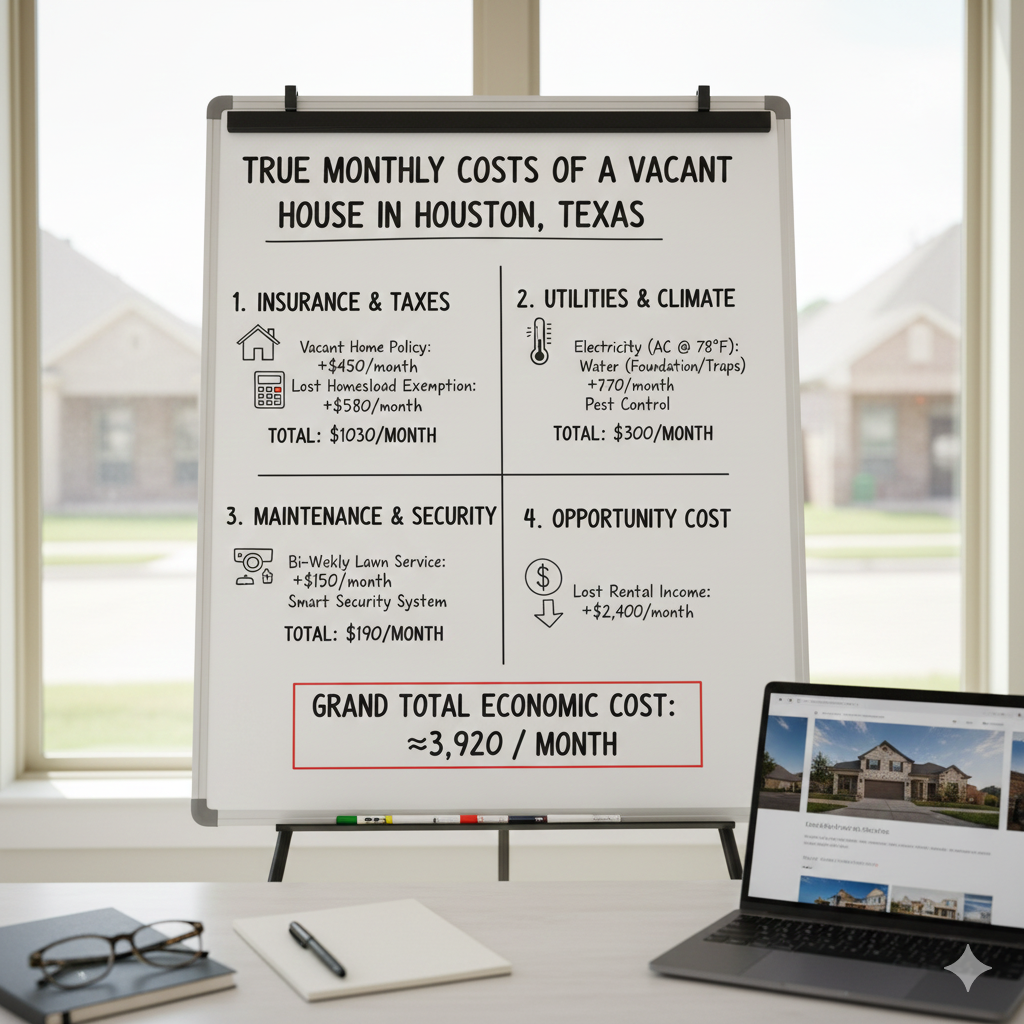

For many Texas property owners, a vacant house feels like a temporary state—a "waiting room" between a tenant moving out and a new one moving in, or the quiet period after inheriting a family estate. However, in the high-stakes real estate markets of Houston, Dallas, and Austin, "quiet" is often the most expensive sound a landlord can hear.

The financial reality of an empty home goes far beyond the obvious loss of monthly rent. In the Lone Star State, where the climate is aggressive and property taxes are among the highest in the nation, the "carrying costs" of a vacant property can erode your equity at an alarming rate. If you find yourself stuck with an empty house that is draining your bank account, you might be looking for Cash Home Buyers who can help you liquidate the asset before the hidden costs spiral out of control.

In this comprehensive guide, we will break down the true monthly and annual costs of leaving a house vacant in Texas, from insurance surcharges and tax shifts to the high price of "humidity management" in a Gulf Coast climate.

The Insurance "Vacancy Surcharge"

One of the first financial shocks a Texas homeowner faces when a property becomes empty is the shift in insurance premiums. Most standard homeowners insurance policies are designed for owner-occupied residences. Once a home sits empty for more than 30 to 60 days, your standard coverage may become void.

1. Transitioning to Vacant Home Insurance

To protect the asset, you must switch to a Vacant Home Policy. Because insurance companies view empty houses as significantly higher risks for vandalism, fire, and undetected water leaks, they charge accordingly. In 2025, data suggests that vacant home insurance in Texas can cost 50% to 150% more than a standard policy. For a $350,000 home in Houston, this could mean an annual premium jumping from a standard $2,800 to over $6,500.

2. High Deductibles and Limited Coverage

Even with a premium policy, you may face a higher deductible (often 2% to 5% of the dwelling value) for perils like wind or hail. Furthermore, many vacant policies exclude coverage for theft or vandalism unless you pay for a specific rider. This means you are paying significantly more for restricted protection. If a pipe bursts on day 45 of vacancy and you haven't updated your policy, your carrier may deny the claim based on a "neglect" or "vacancy" clause.

The Relentless Toll of Texas Property Taxes

Texas property taxes are a significant portion of the cost of ownership, and they do not pause just because the house is empty. In fact, for many owners, the tax burden actually increases when a home becomes vacant.

1. The Loss of the Homestead Exemption

If the vacant house was previously your primary residence, you likely benefited from the Texas Homestead Exemption. In 2025, thanks to Proposition 13, this exemption was increased to $140,000 for school district taxes. However, to qualify, the home must be your principal residence. Once you move out and the home is labeled "vacant" or "secondary," you lose this massive deduction. In Harris County, losing your homestead status can lead to a tax bill increase of $1,500 to $2,500 per year just from the loss of the exemption, not even accounting for the loss of the 10% appraisal cap.

2. Average Monthly Tax Burden

With Houston-area tax rates often totaling around 2.1% to 2.5% of market value, a $300,000 house carries an annual bill of roughly $7,000. This means that every single month the house sits vacant, you are effectively "paying" **$580 in taxes alone**, with no rental income to offset it. This is a "silent" cost that many owners forget until the bill arrives in October.

Humidity and Utility Costs: The Houston "Hidden" Fee

In Texas—and specifically in the Houston metro area—you cannot simply "shut off" a house. The climate will destroy an unconditioned building in a matter of weeks.

1. The Cost of Mold Prevention

To prevent mold and wood rot, you must keep the HVAC system running. In 2025, professional mold remediation for a whole house in Houston can range from $10,000 to $30,000. To avoid this, you must keep the AC at 78°F or lower and ensure the humidity stays below 55%. In a typical 2,000-square-foot Houston home, keeping the air running during a brutal July or August can still result in an electric bill of $180 to $220 per month, even with no lights or appliances being used.

2. Plumbing and Foundation Care

During the scorching Texas summers, the clay-heavy soil around a foundation can shrink, leading to cracks that cost $15,000+ to repair. Many owners of vacant homes must invest in foundation "soaker hoses" and timers. Additionally, you must pay for a "base" water and sewer charge (usually $50–$70) just to keep the lines active and prevent sewer gases from entering the home through dried-out P-traps.

3. Total Monthly Utility Estimate

When you combine electricity (for HVAC), water (for foundation and traps), and basic security monitoring, the average vacant home in a Texas metro area costs between $300 and $450 per month just to stay in "marketable" condition.

Maintenance, Security, and Curb Appeal

A vacant home that looks vacant is a magnet for trouble. To protect your investment and comply with local ordinances, you must maintain a "lived-in" appearance, which carries its own price tag.

1. Landscaping and City Fines

The City of Houston and local HOAs are aggressive about lawn maintenance. In 2025, a single bi-weekly mowing service in Houston averages $45 to $80 per visit. If your grass exceeds 9 inches, city fines can reach $500 per occurrence. Budgeting **$150 per month** for basic yard care is a necessity to avoid municipal liens and HOA "forced mows."

2. Security Risks and Squatters

With no one there to watch the property, theft of copper from AC units remains a major issue in the Houston area. Replacing an outdoor condenser can cost $4,000 to $6,000. Installing a monitored alarm system or smart cameras adds another $40 to $60 per month, but it is a vital expense to prevent squatters from moving in and forcing you into a 60-day eviction process.

3. The "Opportunity Cost" of Lost Rent

This is the most significant "hidden" cost. If the home could rent for $2,400 per month, every month it sits vacant is a permanent loss of that $2,400. Unlike a stock that might bounce back, vacant rent is cash flow that is gone forever. By the time a house sits vacant for six months, the owner has lost over $14,000 in gross revenue—enough to have paid for a major renovation.

The Compounding Cost of Deterioration

Beyond the monthly bills, vacant homes suffer from "mechanical stagnation." When systems aren't used, they fail.

Appliance Seals: Dishwashers and washing machines rely on water to keep seals moist. When they sit dry for months, these seals crack, leading to leaks the first time a new occupant turns them on.

Pest Infestations: Without human activity, pests like termites, silverfish, and rodents can establish colonies undetected. A standard pest control contract for a vacant home usually runs $40 to $70 per month.

Dust and Stale Air: Vacant homes develop a distinct "smell" that can turn off retail buyers. Professional "deep cleaning" before a showing after months of vacancy can cost $300 to $500.

If you calculate the total out-of-pocket costs for a $350,000 vacant home in Texas, including taxes, insurance, utilities, and maintenance, you are looking at a "burn rate" of roughly **$1,600 to $1,900 per month**. This doesn't include the $2,400 in lost rent, bringing the total economic impact to nearly **$4,000 every 30 days**.

Frequently Asked Questions (FAQ)

Is it cheaper to leave a house vacant or rent it out at a discount?

It is almost always cheaper to rent it at a discount. Even a $300/month discount is far better than losing 100% of the rent while still paying for taxes, high-cost vacant insurance, and the increased utility bills required for mold prevention.

Does Texas offer any property tax relief for vacant homes?

No. There is no "vacancy credit" in the Texas Property Code. In fact, if the home stays vacant for more than two years, the Appraisal District may permanently remove your Homestead Exemption, making it very difficult to re-apply later without moving back in.

What is the biggest danger to a vacant house in Houston?

Mold and humidity. Because of the local climate, a 24-hour power outage in a vacant home can lead to $10,000+ in mold damage during the summer. This is why having a "monitored" thermostat is critical for vacant Houston properties.

Can I turn off the water to save money?

You can shut off the main valve, but you should not leave the pipes dry for long periods. Doing so can cause seals to dry out and gaskets to fail. Furthermore, dry P-traps will allow sewer gas (and pests) into the home. It is better to keep the water on and use a smart leak-shutoff valve like Flo by Moen.

How much does it cost total per month to own a vacant $300k house in Texas?

When you add up taxes ($580), Vacant Insurance ($450), Utilities ($350), and Maintenance ($150), the "out of pocket" cost is roughly $1,530 per month. If you add in the $2,200 of lost rental income, the total economic cost is **$3,730 per month**.

Should I keep the house furnished while it's vacant?

Unless you are using "professional staging" to sell the home, it is better to leave it empty. Furniture can trap moisture, provide nesting material for pests, and make it harder to spot foundation cracks or water leaks during your bi-weekly inspections.

Conclusion: Stop the Financial Hemorrhage

Leaving a house vacant in Texas is never truly "free." Every day that passes is a day that your property taxes accrue, your insurance premiums rise, and the Texas sun beats down on your roof and foundation. For many owners, the stress of managing a vacant property from afar—or the fear of a midnight phone call about a burst pipe or a squatter—simply isn't worth the potential future gain.

In 2025, with rising costs for labor and materials, the price of "waiting" has never been higher. According to Texas Real Estate News, homes that sit vacant for more than 90 days often sell for 10-15% less than those that are sold quickly, as buyers begin to suspect hidden "neglect" issues.

If the math of vacancy isn't working in your favor, it's time to take action. Whether you choose to hire a property manager to fill the home with a tenant or decide that we buy houses Houston professionals are the fastest way to stop the bleeding, don't let your equity evaporate into the Texas heat. Reclaiming your financial peace of mind starts with recognizing that an empty house is a liability, not just an asset.

How Absolute Properties Helps Houston Sellers

Absolute Properties makes it easy for Houston homeowners to sell fast - even when facing challenges like financial difficulties, inherited properties, troublesome tenants, or repairs.

If you’re thinking, “I need to sell my house fast in Houston…” We buy houses in Houston in any situation or condition!

As-is, fast cash offers with clear terms

Many closing costs covered; no realtor commissions in most cases

You choose the closing date (as little as 7 days, case-dependent)

Coordination with experienced title company for a compliant sale process

Call or text: (713) 230-8059

Email address: info@absolutepropertieshtx.com

Share your street address and timeline for a free consultation and a straightforward number no pressure.

Helpful Houston Blog Articles

How To Sell Your House in Houston Without Sinking Any More Money Into It

6 Tips For First Time Home Sellers in Houston

Hiring an Agent Vs. A Direct Sale to Absolute Properties When Selling Your House in Houston

Who Pays Closing Costs in Texas

The True Costs of An FSBO Listing for Houston Investors

What To Do With Your Expired Listing in Houston

Also check out our Free Guides & Education & FAQ for more education on how to sell your house for cash quickly to a local home buyer.