What Happens to a House When Someone Dies Without a Will in Texas?

Reviewed by Mark Lee

When someone passes away without a will in Texas, their property doesn't simply transfer to the nearest relative or disappear into legal limbo. Instead, Texas intestacy laws create a specific framework determining exactly who inherits the deceased person's assets, including their home. For families navigating this complex situation, understanding these laws becomes essential, particularly when multiple heirs are involved or quick decisions are needed. Many families facing inherited property situations discover that working with cash home buyers can provide swift solutions during emotionally challenging times, especially when heir disagreements or financial pressures demand immediate action.

The absence of a will means the state of Texas essentially writes one for the deceased through its intestacy statutes. These laws establish a detailed hierarchy of inheritance based on family relationships and distinguish between different types of property ownership. While this legal framework provides structure, it often creates complications that wouldn't exist with proper estate planning.

Understanding Texas Intestacy Laws for Real Estate

Inheritance depends heavily on family structure, marital status, and whether children are from the same marriage.

If the Deceased Was Married With Children

The surviving spouse typically keeps their share

Children inherit the deceased’s portion

Stepchildren do not inherit automatically

If the Deceased Was Married With No Children

The spouse often inherits the entire property

Separate property rules may still apply

If the Deceased Was Not Married

Children inherit equally

If no children exist, parents or siblings may inherit

If No Legal Heirs Exist

Only in rare cases does property escheat to the State of Texas

These rules frequently surprise families — especially blended families — and often lead to disputes.

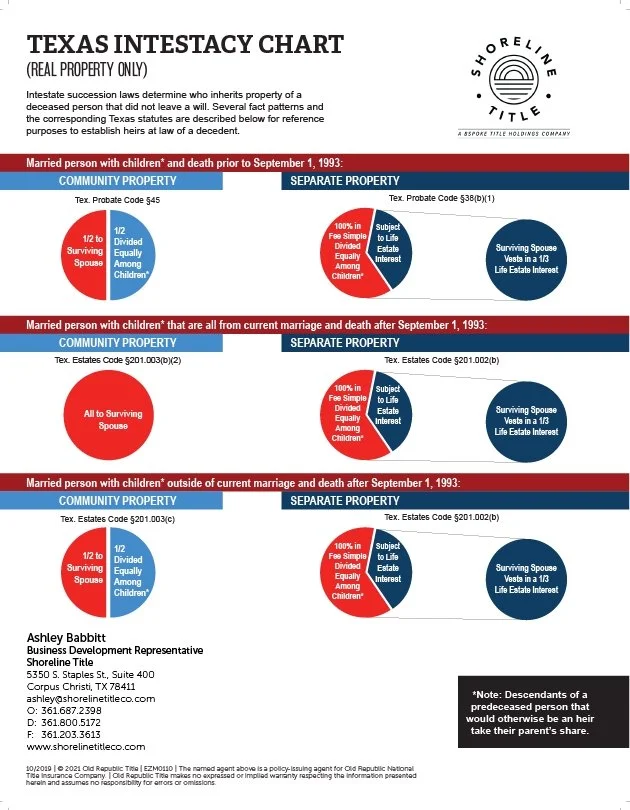

Texas intestacy laws divide all property into two fundamental categories: community property and separate property. This distinction, rooted in Texas's Spanish legal heritage, fundamentally affects who inherits a house when someone dies without a will. Community property includes assets acquired during marriage through either spouse's efforts, while separate property consists of assets owned before marriage, inherited property, or gifts given specifically to one spouse.

When a married person dies without a will, the surviving spouse's inheritance depends on whether the deceased had children and whether those children were from the current marriage. If all surviving children are from both spouses, the surviving spouse inherits all community property. However, if the deceased had children from another relationship, those children inherit the deceased's half of community property immediately, creating shared ownership between the surviving spouse and stepchildren—a situation frequently leading to tension and practical difficulties.

Separate property follows different distribution rules. A surviving spouse receives a life estate in one-third of separate real property, meaning they can use the property during their lifetime, but the deceased's children own the underlying property rights. This arrangement often creates complicated ownership situations requiring careful legal navigation and formal agreements about property maintenance and expense sharing.

For unmarried individuals, the inheritance hierarchy follows a straightforward progression. Children inherit everything equally, regardless of their relationship with each other. If there are no children, parents inherit the entire estate. Without surviving parents, siblings and their descendants become heirs. The law continues through increasingly distant relatives, including grandparents, aunts, uncles, and cousins, before property would escheat to the state—an outcome that rarely happens.

The Legal Process of Transferring Property Without a Will

Transferring property ownership after someone dies without a will requires navigating formal probate proceedings. The process begins with filing an application for estate administration in the probate court where the deceased lived. This initial filing must include a death certificate, information about known heirs, and preliminary asset inventory.

Since no executor was named, the court appoints an administrator to manage estate affairs. The court follows statutory preference, appointing the surviving spouse first, then adult children, parents, or other relatives. The appointed administrator typically must post a bond to protect the estate from potential mismanagement.

The administrator receives Letters of Administration, official documents providing legal authority to act on the estate's behalf. These letters are essential for accessing bank accounts, obtaining property deeds, and conducting real estate transactions. Without these letters, third parties refuse to recognize the administrator's authority.

A crucial step unique to intestate estates is the determination of heirship proceeding. The court must formally establish legal heirs through testimony from at least two disinterested witnesses familiar with family history. An attorney ad litem represents unknown heirs' interests during this process. The resulting court judgment declares legal heirs and their ownership percentages, creating the official record needed for property transfer.

During administration, the administrator manages the property responsibly, including maintaining insurance, paying taxes, addressing repairs, and securing vacant properties. These responsibilities continue until the property transfers to heirs or sells as part of estate settlement. The process typically takes six to twelve months for straightforward estates.

Common Challenges with Inherited Property

Multiple heir ownership creates significant practical challenges. When several people inherit fractional interests in a house, every major decision requires agreement among all heirs. This includes decisions about selling versus keeping, setting listing prices, accepting offers, authorizing repairs, or selecting tenants. Disagreements lead to stalemates where nothing gets accomplished while expenses accumulate and family relationships deteriorate.

Outstanding mortgages add complexity to intestate property transfers. The estate remains responsible for mortgage payments, and missing payments can trigger foreclosure proceedings. If the estate lacks liquid assets, heirs must contribute personal funds or arrange a quick sale. Many mortgages contain due-on-sale clauses requiring full payment upon the borrower's death, though federal law provides some protections for inheriting relatives.

Property maintenance costs continue regardless of probate proceedings. Property taxes accumulate with penalties for late payment. Insurance premiums must be maintained. Utilities, lawn care, and emergency repairs require immediate attention. When heirs disagree about sharing costs or cannot afford their share, contributing heirs may have claims against non-contributing heirs, though enforcing these claims requires legal action.

Title issues frequently complicate intestate transfers. Without clear documentation through a will, title companies identify problems that prevent future sales. These include questions about heir identification, potential claims from unknown heirs, or confusion about ownership percentages. Resolving title issues requires additional legal proceedings or specialized title insurance endorsements.

Options for Heirs

Heirs have several options when dealing with inherited property, each with distinct advantages and challenges. Understanding these alternatives helps families choose solutions serving their collective interests while minimizing conflict.

Selling the property and dividing proceeds often provides the cleanest resolution. Traditional market sales yield the highest prices but require time, preparation, and cooperation among heirs. Alternatively, selling to real estate investors enables faster transactions with less complexity, though at potentially lower prices. The speed and certainty of investor purchases can outweigh price differences when conflicts exist or debts require immediate payment.

One heir buying out others allows keeping property with sentimental value while compensating other heirs. This requires accurate valuation, sufficient financing, and careful transaction structuring. Buyout arrangements might involve immediate cash payments, installment plans, or combinations of cash and promissory notes, all requiring proper documentation.

Maintaining joint ownership requires exceptional cooperation and comprehensive agreements about property use, expense sharing, maintenance responsibilities, and dispute resolution. Without detailed written agreements, joint ownership invariably leads to disputes.

When heirs cannot agree, partition proceedings provide a legal remedy. Any co-owner can petition the court to force property sale, with proceeds distributed according to ownership percentages. While partition ensures resolution, it involves substantial legal costs and often below-market sale prices.

Frequently Asked Questions

How long before heirs can sell inherited property?

Heirs typically cannot sell immediately after death. The estate must go through probate to establish clear title, usually taking minimum six months. The administrator needs court appointment and Letters of Administration before conducting sales. In independent administration, sales proceed once the administrator has authority. Dependent administration requires court approval, potentially adding months.

Can one heir force others to sell?

A single heir cannot force voluntary sale without unanimous agreement. However, any heir can file partition lawsuit forcing sale through court proceedings. Partition typically takes four to six months with substantial legal fees reducing distribution proceeds. Courts generally grant partition requests unless exceptional circumstances exist.

What happens to personal belongings inside?

Personal property also passes through intestacy laws. The administrator inventories and distributes belongings. Sentimental items often cause disputes. The administrator should document everything, allow heirs to express preferences, and facilitate fair distribution. If agreement fails, items may be sold with proceeds divided.

Who pays property expenses during probate?

The estate bears primary responsibility for expenses, paid from available funds. If insufficient, heirs wanting to preserve property must contribute proportionally. Heirs paying more than their share can seek reimbursement or credits against property value in final distribution.

Can heirs move in immediately?

Heirs cannot automatically occupy property without agreement from others and the administrator. Occupancy rights must be negotiated, considering whether rent will be paid, credits provided for maintenance, or occupancy counted as inheritance distribution. Written agreements prevent disputes.

What if unknown heirs appear later?

Texas law provides procedures for unknown heirs surfacing after distribution. The heirship proceeding includes attorney representation for unknown heirs. If legitimate heirs appear later with proof, they may have claims against distributed assets. This risk makes thorough heir searches essential.

Planning to Avoid Complications

Understanding intestate succession should motivate proper estate planning. Even simple wills prevent most complications, providing clear instructions for property distribution. The modest cost of creating a will pales compared to financial and emotional costs families face during intestate administration.

For those currently dealing with intestate property, professional guidance helps navigate the process successfully. Attorneys ensure legal compliance, real estate professionals maximize property value, and financial advisors address tax implications. Clear communication among heirs and proper documentation protect everyone's interests.

The Texas intestacy process, while providing a legal framework, creates challenges that proper planning easily avoids. Whether facing these issues now or planning for the future, understanding the law and available options empowers better decisions. Taking action today—either addressing current intestate property or creating estate plans—prevents unnecessary complications and preserves both family wealth and relationships.

External Links:

Texas Law Help - Intestacy Information - Free legal information about intestacy laws

State Bar of Texas - Probate Resources - Official probate guidance

How Absolute Properties Helps Houston Sellers

Absolute Properties makes it easy for Houston homeowners to sell fast - even when facing challenges like financial difficulties, inherited properties, troublesome tenants, or repairs.

If you’re thinking, “I need to sell my house fast in Houston…” We buy houses in Houston in any situation or condition!

As-is, fast cash offers with clear terms

Many closing costs covered; no realtor commissions in most cases

You choose the closing date (as little as 7 days, case-dependent)

Coordination with experienced title company for a compliant sale process

Call or text: (713) 230-8059

Email address: info@absolutepropertieshtx.com

Share your street address and timeline for a free consultation and a straightforward number no pressure.

Helpful Houston Blog Articles

How To Sell Your House in Houston Without Sinking Any More Money Into It

6 Tips For First Time Home Sellers in Houston

Hiring an Agent Vs. A Direct Sale to Absolute Properties When Selling Your House in Houston

Who Pays Closing Costs in Texas

The True Costs of An FSBO Listing for Houston Investors

What To Do With Your Expired Listing in Houston

Also check out our Free Guides & Education & FAQ for more education on how to sell your house for cash quickly to a local home buyer.