Should You Rent or Sell Your Texas Home Before Relocating?

Reviewed by Mark Lee

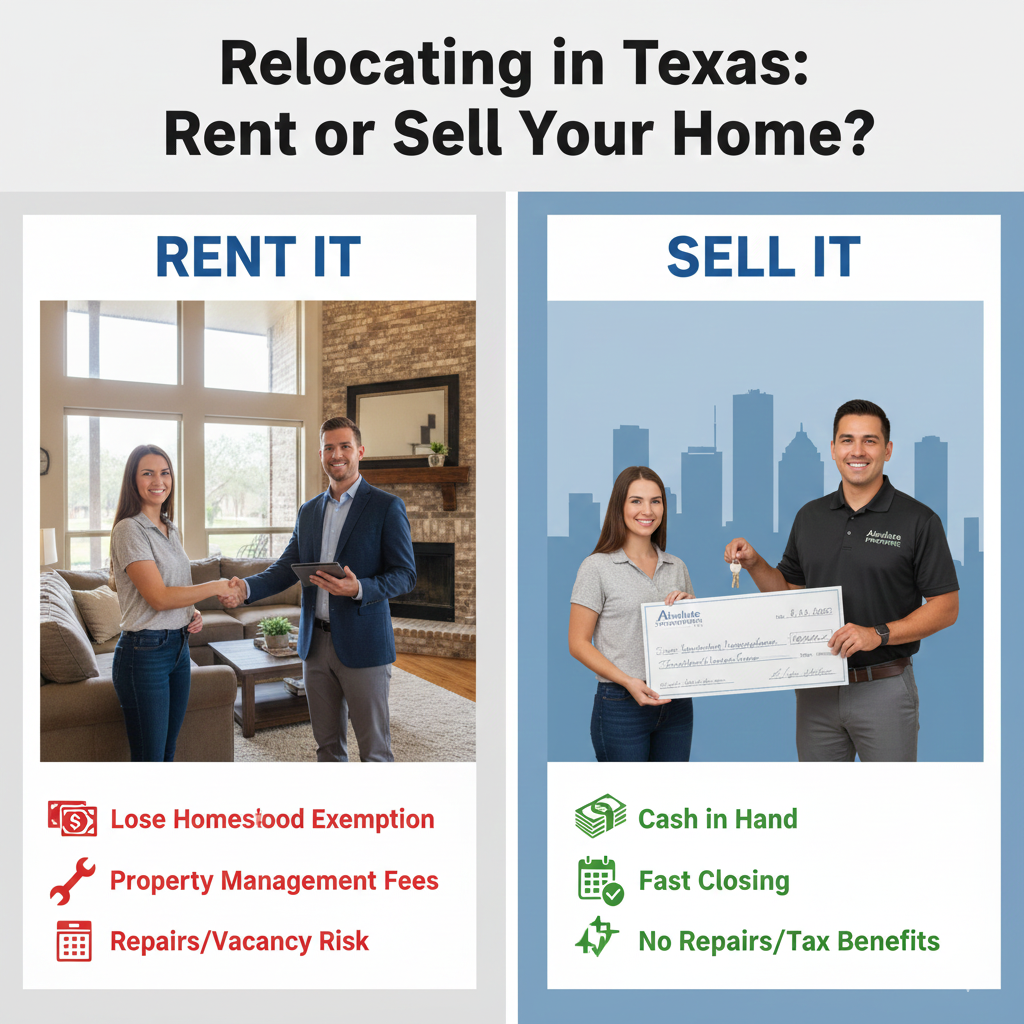

Deciding whether to rent or sell your home before relocating for work is one of the most significant financial decisions you will face. In the Texas real estate market of 2025, this choice is no longer just about personal preference; it’s about navigating shifting property tax laws, a cooling rental market in some metros, and the logistics of remote property management.

Whether you are moving from the energy hubs of West Texas or the medical centers of Houston, the pressure of a relocation timeline can make it difficult to weigh your options objectively. If you find that the repairs and listing process are too much to handle before your start date, seeking out Cash Home Buyers can provide the immediate exit you need to focus on your new career.

This guide provides a deep dive into the 2025 Texas real estate landscape to help you determine if you should keep your home as an investment or sell it for a clean break.

The Financial Reality of the 2025 Texas Rental Market

The "Landlord Dream" in Texas has shifted over the last 24 months. While Texas cities like Houston and Dallas remain high-growth areas, the massive influx of new construction has changed the supply-and-demand dynamic. According to the 2025 Texas Real Estate Forecast from Texas A&M University, single-family rents are stabilizing rather than surging, which means your potential profit margins may be thinner than you expect.

Rent Oversupply and Vacancy Rates

In 2025, many Texas metros are seeing record numbers of apartment deliveries and build-to-rent communities. This creates direct competition for your single-family home. If your home is in a suburb where new developments are popping up, you may face longer "days on market" to find a qualified tenant. A vacant property is the biggest threat to a relocating homeowner’s budget, as you will be responsible for the mortgage on a home that isn't producing income.

Professional vs. Accidental Landlords

There is a significant difference between being a professional investor and an "accidental landlord." When you relocate for work, you become the latter. You must ask yourself if you have the "stomach" for emergency repairs, tenant disputes, and the inevitable wear and tear on your primary asset. In Texas, where the summer heat can lead to $5,000 AC replacements in an afternoon, having a cash reserve is non-negotiable.

The Hidden Cost: Loss of the Texas Homestead Exemption

Perhaps the most overlooked factor in the "rent vs. sell" debate is the massive impact of Texas property taxes. Texas has some of the highest property taxes in the nation because there is no state income tax. As a resident, you likely benefit from a General Residence Homestead Exemption, which not only lowers your taxable value but also caps the amount your assessment can increase each year at 10%.

The Tax Jump After Moving

The moment you move out and rent your home, it is no longer your primary residence. You are legally required to notify the county appraisal district. Once the homestead exemption is removed, your property tax bill will spike. Not only do you lose the flat-dollar discount on school taxes, but the 10% "cap" on assessment increases disappears. In a hot market, your property taxes could jump 20% or 30% in a single year, potentially wiping out your entire rental profit.

Capital Gains Tax Deadlines

The IRS allows you to exclude up to $250,000 (single) or $500,000 (married) in capital gains if you have lived in the home for two of the last five years. If you rent your house for three years or more, you risk losing this exclusion entirely. Selling now allows you to pocket that equity tax-free, whereas renting for too long could result in a massive tax bill when you finally decide to sell.

Remote Management: The Logistics of Being an Out-of-State Owner

Managing a Texas home from another state is complicated. Even with a property management company, the distance adds a layer of stress that many relocating professionals find overwhelming.

Property Management Fees in Texas

In cities like Houston and Dallas, standard property management fees range from 8% to 12% of the monthly rent. Additionally, most managers charge a "leasing fee" (often 75% to 100% of the first month's rent) every time they place a new tenant. Between the management fee, the leasing fee, and the maintenance markups, you may find that your "passive income" is largely going to the management company rather than your bank account.

Legal and Compliance Risks

Texas landlord-tenant laws were updated significantly in 2025. For example, SB 17 introduced new restrictions on certain foreign ownership and lease terms, and there are strict requirements for background checks and security deposit handling. Failure to comply with these local statutes can lead to lawsuits or heavy fines. If you are focused on a high-pressure new job, you may not have the time to ensure your rental is 100% compliant with the Texas Property Code.

Why Selling Provides the "Clean Break" for Relocation

For many professionals, the primary goal of relocation is a fresh start. Selling your home before you move—or shortly thereafter—provides several psychological and financial advantages.

Releasing Your Equity for the Next Purchase

Unless you have significant liquid savings, you will likely need the equity from your current Texas home to place a down payment on your new residence. Renting your current home keeps that equity "trapped." While you can take out a Home Equity Line of Credit (HELOC), these often have higher interest rates than a standard mortgage and add to your monthly debt-to-income ratio, which could make qualifying for a new home more difficult.

Avoiding "Double-Carrying" Costs

The biggest fear for any relocating homeowner is the "double mortgage." If your house doesn't rent quickly, or if your tenant stops paying, you are on the hook for two sets of housing costs. By selling to an investor or on the open market before you move, you eliminate this risk entirely. A fast sale allows you to walk away with a check in hand and no lingering ties to your old city.

Assessing Your Home’s "Rentability"

Not every house makes a good rental. Before deciding to keep the property, perform an honest assessment of its features.

School Districts and Commute Times

High-performing school districts in areas like Katy, The Woodlands, or Frisco drive rental demand. If your home is in a top-tier district, you will have an easier time finding long-term tenants. However, if your home is in an area with lower demand or high crime rates, you may find yourself constantly dealing with high tenant turnover and property damage.

Maintenance-Heavy Features

Does your home have a swimming pool? A large, landscaped yard? An aging roof? These are "liability magnets" for landlords. In Texas, pools require expensive weekly maintenance and carry high insurance premiums. If your home is "high-maintenance," it is almost always better to sell it as-is to a buyer who wants to take on those projects rather than trying to manage them from afar.

FAQ: Renting vs. Selling for Texas Relocation

What happens to my mortgage rate if I rent my house?

Most "owner-occupant" mortgages have a clause requiring you to live in the home for at least one year. If you have lived there longer than that, you can typically keep your current mortgage rate when you convert it to a rental. However, you must notify your insurance company, as a standard homeowners policy will not cover a rental property. You will need a "Landlord Policy" (DP3), which usually costs 20–25% more.

Is rental income in Texas taxable?

While Texas has no state income tax, your rental income is subject to federal income tax. You can offset this income with deductions for mortgage interest, property taxes, insurance, and depreciation. Depreciation is a powerful tool, but remember that the IRS will "recapture" those taxes when you eventually sell the home.

How do I know if my house will "cash flow"?

A simple rule of thumb is the 1% rule: the monthly rent should be at least 1% of the purchase price. However, in Texas, the high property taxes often require a higher ratio to truly cash flow. Subtract your mortgage, taxes, insurance, a 10% management fee, and a 10% maintenance reserve from your expected rent. If the number is negative, you are "paying" to own the rental every month.

Should I sell my house if it needs major repairs?

If you are relocating, you likely don't have time to manage a major renovation. In this case, selling to a cash buyer who specializes in "as-is" properties is often the best move. It allows you to skip the repair process and the inspections that often kill traditional real estate deals.

Can I change my mind and sell later?

Yes, but be careful of the "two-out-of-five" rule for capital gains. If you rent for more than three years, you could owe the IRS 15–20% of your home's appreciation in taxes. For many Texans who have seen their homes double in value over the last decade, this tax bill can be tens of thousands of dollars.

Conclusion

The decision to rent or sell your home before relocating in Texas comes down to your long-term goals. If you are moving temporarily and plan to return to your Texas home within two years, renting may be a viable bridge. However, if your move is permanent and you want to maximize your financial flexibility, selling is usually the superior choice.

By selling, you avoid the rising property taxes associated with losing your homestead exemption, eliminate the stress of remote landlording, and unlock your equity for your next chapter. If the traditional market timeline doesn't fit your job's start date, remember that there are options to sell quickly and move on with total peace of mind.

How Absolute Properties Helps Houston Sellers

Absolute Properties makes it easy for Houston homeowners to sell fast - even when facing challenges like financial difficulties, inherited properties, troublesome tenants, or repairs.

If you’re thinking, “I need to sell my house fast in Houston…” We buy houses in Houston in any situation or condition!

As-is, fast cash offers with clear terms

Many closing costs covered; no realtor commissions in most cases

You choose the closing date (as little as 7 days, case-dependent)

Coordination with experienced title company for a compliant sale process

Call or text: (713) 230-8059

Email address: info@absolutepropertieshtx.com

Share your street address and timeline for a free consultation and a straightforward number no pressure.

Helpful Houston Blog Articles

How To Sell Your House in Houston Without Sinking Any More Money Into It

6 Tips For First Time Home Sellers in Houston

Hiring an Agent Vs. A Direct Sale to Absolute Properties When Selling Your House in Houston

Who Pays Closing Costs in Texas

The True Costs of An FSBO Listing for Houston Investors

What To Do With Your Expired Listing in Houston

Also check out our Free Guides & Education & FAQ for more education on how to sell your house for cash quickly to a local home buyer.